This license is issued by the local government or county and must be obtained before a business can legally operate. Let an expert do your taxes for you, start to finish with TurboTax Live Full Service. Or you can get your taxes done right, with experts by your side with TurboTax Live Assisted. Just answer simple questions, and we’ll guide you through filing your taxes with confidence. When you’re in business, you give and receive plenty of receipts in a year.

IRS offers significant reprieve from FTC regulations – Grant Thornton

IRS offers significant reprieve from FTC regulations.

Posted: Tue, 25 Jul 2023 07:00:00 GMT [source]

If you would like a tax expert to clarify it for you, feel free to sign up for Keeper. At Keeper, we’re on a mission to expose regressive misconceptions — like the myth that paper receipts are the only acceptable kind of tax record. Even if you forgot to document a cash purchase of over $75, you’re not completely out of luck. If you’re able to rustle up, say, an email to a contractor discussing the cash payment you gave them, you can use this to reconstruct that expense. If you walk into an Apple store and pay cash for a pair of AirPods for work calls, hang onto your receipt.

What Receipts Should You Keep For Taxes?

Itemized receipts are required for the actual substantiation of business and travel meals. For meals, oftentimes you will need two (2) receipts to show all of the necessary information. One receipt will show what was purchased, and the second receipt will show how you paid. Receipts are a key part of recordkeeping, but they aren’t the only supporting documents you need to keep. According to the IRS, supporting documents also include sales slips, paid bills, invoices, deposit slips, and canceled checks. Purchases are the items that you may buy and resell in your business.

- There is some uncertainty as to what a charity should do when it receives a request to charge a credit card prior to the calendar year end but doesn’t do so until early January.

- If you filed a fraudulent return or didn’t file at all, then there’s no limit on how long the IRS has to complete an audit.

- Keeping accurate and organized records can help you to minimize your tax liability and avoid any potential legal or financial issues down the line.

- Wallach provided the Tax Court with bank records and photocopies of receipts for meals, hotels, rental vehicles and airline tickets to substantiate some of his expenses.

- If the tip is not included in the total it should be written on the receipt.

You must keep records of the cost of improvements and repairs to the property. Your Bench bookkeeper ensures that your books are accurate and up to date, which means peace of mind when tax season rolls around. If you upgrade to our Premium plan, we’ll even take care of filing your taxes. These receipts may be paper, of course, but they also might be digital files, which are much easier to store and organize. Remember, a receipt alone is not enough to prove that an expense is deductible. Expenses must be for business purposes and must be what the IRS calls “ordinary, necessary, and reasonable”—that tropical vacation probably won’t qualify.

Are Expense Deductions Without Receipts Tax Deductible?

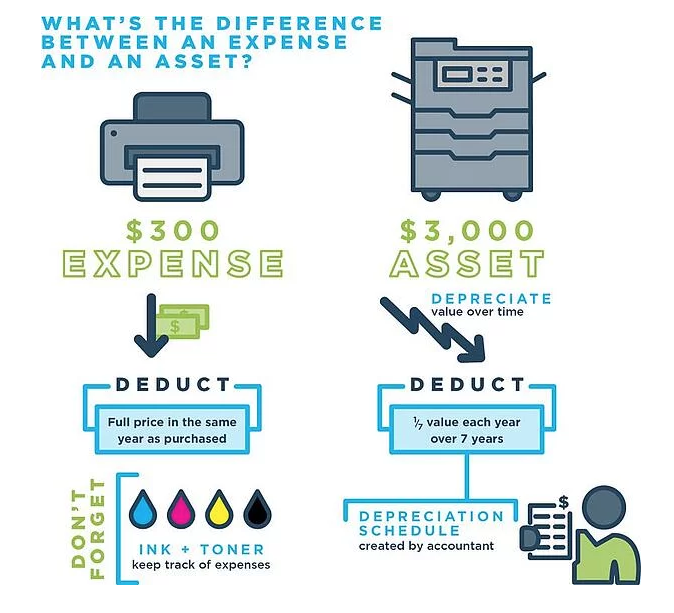

Any property that you purchase to use on your business, such as furniture, vehicles, or machinery is considered an asset. You must always keep records to verify the annual depreciation, and your gain or loss if the asset is sold. Let’s review the records you should be keeping depending on the type of income or expense. An invoice is a request for payment, while a receipt is a document for payment that has already occurred. Businesses frequently use invoices after providing a service to notify the customer of the expected payment.

Because of this, you should keep records of any kind where you spend money on your assets. For example, keep records when you service your bakery’s oven or upgrade your company’s computers. You’ll also want to keep records should you sell one of your assets. If you are being audited, it’s important to work with a qualified CPA or tax audit firm.

Online accounting software can help ease the burden of keeping receipts. But fortunately, nothing says you have to keep the receipt in it’s original paper form. You may hop on a plane to visit a client or take a hotel room for a few nights to attend a conference. While the IRS has very specific instructions for deductible travel expenses, keep the receipts or bills for your travel expenses should you be able to deduct all or part of a trip. The fact that you have a receipt or can otherwise prove that you incurred an expense does not by itself establish that it is deductible.

The following are some of the types of records you should keep:

He said the trip was to scout potential properties for a client. The phones are ringing with frantic calls from donors wanting receipts for prior year donations to support a deduction on their personal tax returns. Organize small business receipts to simplify tax time, keep your accounting books accurate, and keep your financial documents in order. Use a method that makes sense to you, such as organizing receipts chronologically and categorizing them by income or expense type.

- Technically, if you do not have these records, the IRS can disallow your deduction.

- You don’t need to record the details of every expense on the day you incur it.

- Some dependent care expenses may qualify for a tax credit, including money paid to a daycare provider, babysitter, after-school program, or day camp.

- In most cases, you can deduct your state and local income taxes when you file your federal tax return.

Here’s a list of all the small business tax deductions for which you might qualify. It’s important to develop a system that works for you and your business. By keeping accurate records and organizing your receipts, you can help to minimize your tax liability and ensure that your business runs smoothly. Consider using accounting software to help manage and organize your receipts. Many accounting software programs allow you to scan and upload receipts, categorize expenses, and generate reports for tax purposes.

File & pay taxes

As a business owner, you may be able to deduct certain expenses related to your business. We covered all kinds of deductions in a blog last month, but in case you missed it, we’ll put the list here. Join over 1 million businesses scanning receipts, creating expense reports, and reclaiming multiple hours every week—with Shoeboxed. In some cases the value of the goods or services provided are so minimal that they are excluded from reporting to the donor. The rules are specific here and generally are only applicable when the item received is of minimal value, such as a logoed pen or hat. In most cases, the value is required to be reported to the individual.

Charities need to be extra careful in this situation and report the correct date on the donor receipt. Otherwise a donor may be disallowed a tax deduction in that year due to the incorrect date. Filing cabinets might be one receipt storage method, but it can be tricky to manage. To save space and protect your receipts from wear and tear, consider organizing receipts electronically. You can organize e-receipts through digital folders or accounting software.

Or forward a receipt to your designated Shoeboxed email account. Read on to find out if your receipt scans have Irs receipts requirements met all of the IRS’s requirements. Get up and running with free payroll setup, and enjoy free expert support.

By “extra proof,” we mean a record of what you were doing and who else was involved. This proves that you paid for the expense for business purposes. Freelancers often think they need physical receipts for every single tax deduction. And remember, if you need help managing payments and invoices for your business don’t forget that PaySimple has a 14 day trial to help you keep great records and streamline your business. Keeping receipts for a minimum of three years may sound daunting, but there are a myriad of resources that exist to make this an easy task to manage. For starters, you can get into the habit of virtually saving copies of virtual receipts and statements.

For some, it is beneficial to deduct your state and local sales tax on your itemized deductions, rather than the amount of state and local income taxes you paid during the year. If you meet this description, you’ll want to save all sales receipts. Keeping good records doesn’t have to mean stashing thousands of paper receipts in your office. Nowadays, there’s a pretty good chance that your records are online and just a click away. Your online bank account and credit card accounts can be mined for most of the information about your spending.

Instead, you must keep a log of the expenses and the business reason for the T&E. You must also keep track of the business purpose, who was present at the event, how much each person spent, and how long the event lasted. Categorizing your receipts can be a pain, but when you work with Bench, we manage that for you.

Charitable Donations

Digital records are not subject to wear and tear as are physical receipts, but they can be lost if a hard drive fails. It’s thus wise to store them on the cloud or somewhere where they can always be accessed. A receipt is a written acknowledgment that something of value has been transferred from one party to another. In addition to the receipts consumers typically receive from vendors and service providers, receipts are also issued in business-to-business dealings as well as stock market transactions. Across America, 1099 contractors and freelancers everywhere continue to stuff their wallets and glove compartments with paper receipts.

The donor is responsible for obtaining a proper valuation for noncash contributions. Even if the charity is knowledgeable in valuing the item donated (such as a museum receiving artwork), the charity should never include the value on the donor receipt. Read on to learn about types of business receipts, the receipts you need for taxes as both a business and individual, and more. Technically, if you do not have these records, the IRS can disallow your deduction.

Employee Retention Credit Applications Attract Heightened IRS … – Dykema

Employee Retention Credit Applications Attract Heightened IRS ….

Posted: Wed, 02 Aug 2023 15:16:31 GMT [source]

These also include the cost of internet advertising, website design, and fees for public relations and advertising consultants. They also include the cost of developing prototypes and formulas. Quickbooks Online allows you to attach a receipt directly to your expense, which makes finding a receipt for any given expense quick and easy. A proper receipt will not serve you in an audit if you can’t find it when needed. Millions of companies use Square to take payments, manage staff, and conduct business in-store and online. According to the IRS, the following items must be documented at the time of your purchase and may not be recreated after the fact.